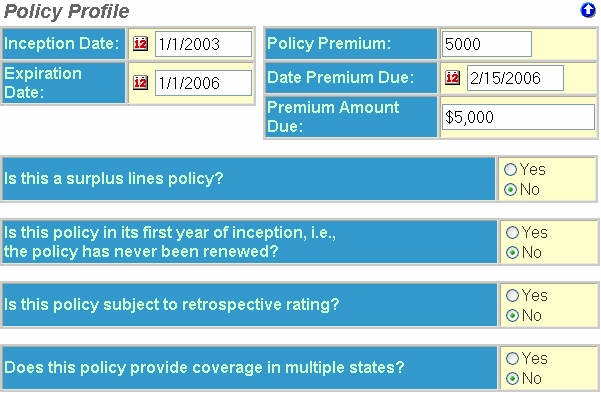

Policy Profile

The Policy Profile section of the Policy Information

page contains the following fields:

Inception Date - This

field contains the date the policy went into effect.

The calendar icon![]() allows

you to view and select dates from a calendar.

allows

you to view and select dates from a calendar.

Expiration Date - This

field contains the date the policy will expire.

Policy Premium - This field contains the total amount of premium for the policy. (For example, if the policy period is one year, then this would be the annual premium of the policy.)

Date Premium Due - This field contains the date the premium is due. (For example, if the premium is payable in installments this would be the due date of the premium installment.)

Premium Amount Due - This

field contains the amount of premium currently due. (For example, if the

premium is payable in installments, this would be the amount of the installment

currently due.)

Explanation of questions pertaining to Policy

Profile:

A surplus

lines policy is one that is written by an Insurer who is licensed

to do hard to place business in a particular state. If a Surplus Lines

Carrier writes this policy, answer yes to this question. In some states,

Surplus Lines policies are not regulated by the insurance code. In those

states, a Surplus Lines policy will not be subject to the same notice

conditions as non-surplus lines or admitted carriers are.

Answer yes to the question regarding a policy's

first year of inception if the policy is new and has never been renewed.

A yes response to this question is applicable only to Cancellation

notices and will determine if the policy is within the Underwriting

Period when the cancellation occurs. The response to this question

will be ignored for notice types other than cancellation.

Answer yes to the question regarding retrospective

rating if the policy is subject to this rating plan. Retrospective

Rating on a policy results in a premium that is based upon the insured's

actual loss experience during the policy term. This method of rating a

policy generally applies to large commercial accounts. In some states,

policies that are retrospectively rated are not regulated by the insurance

code. In those states, a Retro-rated policy will not be subject to the

same notice conditions as are policies that have premiums based upon standard

rates.

A policy providing coverage in multiple states

is one where there are multiple locations and risks in more than one state.

If you answer yes to this question, you should carefully review the information

for all states covered on the policy in ODEN®

State Rules & Regulations. A separate notice should be issued

for each of those states that require regulation of their notice requirements

be met in order to terminate or change the policy. This question is not

applicable for Personal Lines.

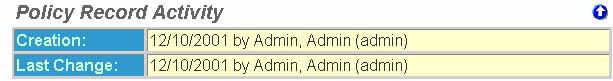

Policy Record

Activity

The Policy Record Activity section of the Policy

Information page contains the following fields:

Creation - This

field displays the login ID of the user that created the policy record

and the date it was created in Policy Terminator®.

Last Change - This

field displays the login

ID of the user that made the last changes to the policy record and

the date they were made in Policy Terminator®.

Link to Policy Help Page

Many features are controlled by user rights. If

a feature does not appear as described in Help, the rights may not be

set up to use that feature. Please contact your System

Administrator. See the Disclaimer page for contact information.